38 calculating tax math worksheets

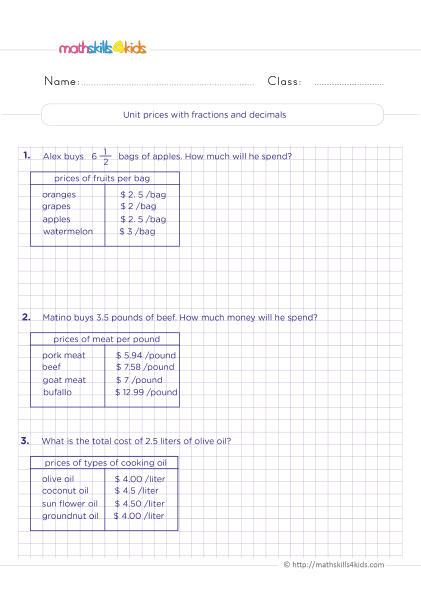

Discount Worksheets - Math Worksheets 4 Kids Here's the formula: discount percent = discount amount ÷ marked price x 100. Finding Selling Price or Marked Price Using Discount Percent What is the marked price if the selling price is $86 after a discount of 6% is applied? Experience the ease of finding the sale price or marked price in this section of our calculating discount worksheets. Capital Gains Tax Calculation Worksheet - The Balance Capital Gains Tax Calculation Worksheet. Building a worksheet to calculate capital gains shows how the math works. It also illustrates how you can organize your investment data for tax purposes. Here's what you'll need to get started: One worksheet for each stock, bond, or other investment you have. Keep all the purchases on the left side.

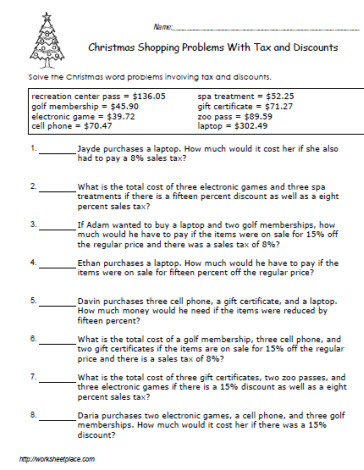

Calculating Tax Worksheet Teaching Resources | Teachers Pay Teachers This resource is great for students who need practice calculating tax, gratuity and discounts from word problems. Problems include scenarios where students are given a total amount of a bill, tax and gratuity percent, and students need to calculate the final amount. Students should know which to calculate first, second, and so on…

Calculating tax math worksheets

Income Tax worksheet - Liveworksheets.com Income Tax Calculating income tax and money received after deductions. ID: 1342388 Language: English School subject: Math Grade/level: Secondary ... More Math interactive worksheets. Matching Number Name to Numbers (1-10) by khosang: Addition DJ by CPSGradeOne: Place Value by Gierszewski: Mixed Times Table Calculate Sales Tax | Worksheet | Education.com Entire Library Worksheets Fourth Grade Math Calculate Sales Tax. Worksheet Calculate Sales Tax. It would be great if we never had to learn about sales tax, but since we do, 4th grade is as good a time as any! Throw in some favorite baseball game snacks for fun and get cracking. Add the sales tax and find how much each person's meal will cost. IXL | Learn 6th grade math IXL offers hundreds of sixth grade math skills to explore and learn! Not sure where to start? Go to your personalized ... Percents - calculate tax, tip, mark-up, and more 8. Simple interest W. Time. 1. Elapsed time 2. Time units 3. Find start and end times X. Coordinate plane. 1. Describe the coordinate plane 2. Objects on a coordinate plane 3. Graph points on a coordinate plane 4. …

Calculating tax math worksheets. PDF Math Tax Worksheet - christianperspective.net Math Tax Worksheet This worksheet is designed to give you a simplified look at filling out a 1040 U.S. Individual Income Tax Return. To do so, you'll have to use some of those math skills you've learned. Ready? Let's get started. A. The first line is where you'd write down what you earned on a job. › workbooks › fifth-gradeBrowse Printable 5th Grade Math Workbooks | Education.com Math is part of everyday life, so learn math concepts with everyday examples. Learn to calculate sales tax, discounts, income, expenses and how to get more bang for your buck! 5th grade tax calculation worksheet Coaching Our Kids With Aspergers: Math Worksheet - Calculating Tax aspiecoach.blogspot.com. calculating worksheet tax worksheets math taxes answers coaching aspergers. Corporate Tax Calculator Template | Excel Templates . tax corporate calculator templates template excel income company calculate sample pay examples open ... PDF Sales Tax Practice Worksheet - MATH IN DEMAND Worksheet Practice Score (__/__) Directions: Solve the following problems on sales tax. Make sure to bubble in your answers below on each page so that you can check your work. Show all of your work! 2 3 4 6 7 1If a table costs $45 and the sales tax is 5%, what is the sales tax? 0.05 Sales Tax = $2.25

PDF Discount, Tax and Tip - Effortless Math Math Worksheets Name: _____ Date: _____ … So Much More Online! ... The sales tax in Texas is 8.25% and an item costs $400. How much is the tax? $_____ 18) The price of a table at Best Buy is $220. If the sales tax is 6%, what is the final price of the table including tax? $_____ ... Ratios - Practice with Math Games Understanding ratios is crucial for solving problems relating to proportions and percents. Math Games makes reviewing this higher-level math skill a breeze, with our suite of enjoyable educational games that students won’t want to stop playing! Our free resources include mobile-compatible game apps, PDF worksheets, an online textbook and more ... Sales Tax - FREE Math Lessons & Math Worksheets from Math Goodies Answer: The sales tax is $1949.35 and the total cost is $29,990.00 + $1949.35 = $31,939.35. As you can see, for small purchases, sales tax can be a nuisance; whereas for large purchases, sales tax can be a significant amount. Let's look at an example in which the sales tax rate is unknown. Quiz & Worksheet - Calculating Taxes & Discounts | Study.com Instructions: Choose an answer and hit 'next'. You will receive your score and answers at the end. question 1 of 3 The listed price of a dress is $59.99. If the tax is 8%, what is the total cost?...

› resources › lessonsAlgebra Help - Calculators, Lessons, and Worksheets - Wyzant ... Need to practice a new type of problem? We have tons of problems in the Worksheets section. You can compare your answers against the answer key and even see step-by-step solutions for each problem. Browse the list of worksheets to get started… Still need help after using our algebra resources? Connect with algebra tutors and math tutors ... Applying Taxes and Discounts - WorksheetWorks.com Create a worksheet: Find the price of an item after tax and discount. Applying Taxes and Discounts Using Percentages. Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied. ... Tax Computation Worksheet 2022 - 2023 - TaxUni The Tax Computation Worksheet works the same way as the tax tables. As long as you know the amount(s), you're good to go. Note: The IRS hasn't published the 2022 Tax Computation Worksheet for Form 1040. As soon as the agency releases the Tax Computation Worksheet for 2022 taxes you'll be filing in 2023, it will be added to here. PDF Lesson 3 v2 - TreasuryDirect calculate tax rates (percents) and the dollar amount of taxes. 7. read and understand tax tables. Mathematics Concepts computation and application of percents and decimals, using and applying data in tables, reasoning and problem solving with multi- step problems Personal Finance Concepts income, saving, taxes, gross income, net income

Consumer Math - Basic-mathematics.com Topics in investment. Bonds Learn about what bond, face value, and how to calculate the cost of bond given the face value and the percent shown on the face value.. Savings bond Learn about redemption value and how to calculate the interest given the redemption value and the cost of the bond.. Simple interest Learn how to compute the interest for a principal that is not reinvested.

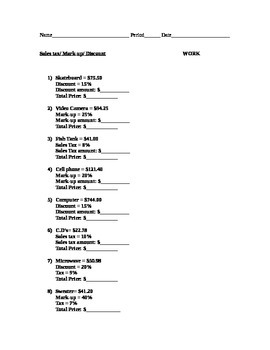

Markup, discount, and tax - Math Worksheet x 155 = 12 100 Now, cross multiply. x ∙ 100 = 12 ∙ 155 100 x = 1860 x = 18.6 18.6 is 12% of 155. Example 2: Let's try another. 9 is what percent of 215? 9 will be our "IS", 215 is our "OF" and we are looking for our percent. 9 215 = x 100 9 ∙ 100 = x ∙ 215 900 = 215 x x = 4.19 Now let's apply this to shopping and figuring out discounts and taxes.

calculating tax worksheet commission worksheet sales commissions calculations quiz study stair structure step calculate explain answer. Tax, Simple Interest, Markups, And Mark Downs . math worksheet interest simple grade tax worksheets problems word 7th sales downs mark markups met purchase standard. Profit And Loss Worksheet briefencounters.ca

PDF Sales Tax and Discount Worksheet - psd202.org Tax: A tax on sales that is paid to the retailer. You need to add the sales tax to the price of the item to find the total amount paid for the item. Procedure: 1.The rate is usually given as a percent. 2.To find the tax, multiply the rate (as a decimal) by the original price. 3.To find the total cost, add the tax to the original price.

Maneuvering the Middle Teaching Resources | Teachers Pay … Maneuvering the Middle is focused on providing student-centered math lessons. On the blog you can find valuable tips for lesson planning, classroom technology, and math concepts in the middle school classroom. After seven years in middle schools around Texas, I feel privileged to focus on high-quality engaging lessons. Allowing you to do what ...

Calculating Sales Tax | Worksheet | Education.com Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems. Download Worksheet See in a set (11) View answers Add to collection

› library › learningEveryday Math Skills Workbooks series - Money Math - CDÉACF invisible. But math is present in our world all the time – in the workplace, in our homes, and in our personal lives. You are using math every time you go to the bank, buy something on sale, calculate your wages, calculate GST or a tip. Money Math is one workbook of the Everyday Math Skills series. The other workbooks are: • Kitchen Math

Adding Taxes Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item including taxes

Browse Printable 5th Grade Math Workbooks | Education.com Math is part of everyday life, so learn math concepts with everyday examples. Learn to calculate sales tax, discounts, income, expenses and how to get more bang for your buck! Learn to calculate sales tax, discounts, income, expenses and how to get more bang for your buck!

› consumer-mathConsumer Math - Basic-mathematics.com Real state tax Learn how a property tax is calculated using some basic math skills. Topics in investment Bonds Learn about what bond, face value, and how to calculate the cost of bond given the face value and the percent shown on the face value.

Taxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX Discount and Sales Tax Lesson Plan Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1)

calculating tax worksheet Self-Employed 401k Contribution Worksheet Free Download. 8 Images about Self-Employed 401k Contribution Worksheet Free Download : Calculating Tax Tip And Commission Practice Worksheet Answers - Tax Walls, Markup, Discount, and Tax (Harder) Worksheet for 8th - 9th Grade and also Self-Employed 401k Contribution Worksheet Free Download.

Quiz & Worksheet - How to Calculate Property Taxes | Study.com Print Worksheet 1. A house has an assessed value of $250,000. The local government has a tax rate of $75 per $1,000 for calculating the property tax. What is the property tax? $20,000 $18,750...

› geometry › quadrilateralsTrapezoid Bases, Legs, Angles and Area, The Rules and Formulas A trapezoid is a quadrilateral with one pair of parallel lines. Bases - The two parallel lines are called the bases.. The Legs - The two non parallel lines are the legs.

Calculating Total Cost after Sales Tax worksheet ID: 839531 Language: English School subject: Math Grade/level: Grade 5 Age: 7-15 Main content: Percentage Other contents: Sales Tax Add to my workbooks (35) Download file pdf Embed in my website or blog Add to Google Classroom

How to calculate taxes and discounts | Basic Concept ... - Cuemath The formula used to calculate tax on the selling price is given below: Tax amount = $(S.P.× T ax rate 100) $ ( S. P. × T a x r a t e 100) Let's consider an example. Let's say an item costs $50, and a sales tax of 5% was charged. What would be the bill amount? Let's first find 5% of 50. 5/100×50 = 2.5

How to Find Discount, Tax, and Tip? (+FREE Worksheet!) - Effortless Math Step by step guide to solve Discount, Tax, and Tip problems. Discount = = Multiply the regular price by the rate of discount. Selling price = = original price - - discount. Tax: To find tax, multiply the tax rate to the taxable amount (income, property value, etc.) Tip: To find tip, multiply the rate to the selling price.

› retirement-plans › self-employedSelf-Employed Individuals – Calculating Your Own Retirement ... Sep 22, 2022 · the deductible portion of your SE tax from your Form 1040 return, Schedule 1, on the line for deductible part of self-employment tax, and; the amount of your own (not your employees’) retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans.

› students › toolsMath.com Calculators and Tools Free math lessons and math homework help from basic math to algebra, geometry and beyond. Students, teachers, parents, and everyone can find solutions to their math problems instantly.

Everyday Math Skills Workbooks series - Money Math - CDÉACF monthly and yearly wages and how federal and NWT tax works. Money Math Workbook 2 Table of Contents. Introduction Introduction Money math 3 Introduction Math is everywhere and yet we may not recognize it because it doesn't look like the math we did in school. Math in the world around us sometimes seems invisible. But math is present in our world all the time – in the …

Math.com Calculators and Tools Free math lessons and math homework help from basic math to algebra, geometry and beyond. Students, teachers, parents, and everyone can find solutions to their math problems instantly. Home | Teacher | Parents | Glossary | About Us: Email this page to a friend: Select Tool · Calculators · Converters · Equation Solvers · Graphers : Resources · Cool Tools · Formulas & …

Self-Employed Individuals – Calculating Your Own Retirement … 22.09.2022 · If you are self-employed (a sole proprietor or a working partner in a partnership or limited liability company), you must use a special rule to calculate retirement plan contributions for yourself.. Retirement plan contributions are often calculated based on participant compensation. For example, you might decide to contribute 10% of each participant's compensation to your …

Algebra Help - Calculators, Lessons, and Worksheets - Wyzant … Need to practice a new type of problem? We have tons of problems in the Worksheets section. You can compare your answers against the answer key and even see step-by-step solutions for each problem. Browse the list of worksheets to get started… Still need help after using our algebra resources? Connect with algebra tutors and math tutors ...

Trapezoid Bases, Legs, Angles and Area, The Rules and Formulas Calculating the sum of the bases $$ 9 + 20 = 29 $$ Step 4. Divide the sum by 2 $$ \frac {29}{2} = \boxed{14.5}$$ Problem 9 . Is the red ... Worksheets; Math Gifs; Teacher Tools; Learn to Code; Calculator; Table of contents. top; Angles; Pract ice prob lem; Area; Midseg ment; Midseg ment Coord Geo; more games . more games . more games . more interesting facts . more …

Property Tax Calculations and Prorations Math Worksheet This video takes students through a DETAILED explanation of how to calculate property taxes using T Bar formulas. There are multiple examples and all are wo...

PDF Worksheet: Calculating Marginal vs. Average Taxes Worksheet, with ... - TD Worksheet: Calculating Marginal vs. Average Taxes Worksheet, with answers (Teacher Copy) Federal Tax Brackets and Rates in 2011 for Single Persons From: To: Taxed at Marginal Rate of: $0 $8,500 10% $8,501 $34,500 15% $34,501 $83,600 25% ... Gr9-12 Taxes Worksheet TEACHER VERSION.docx

Sales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values.

Sales Tax Worksheets Teaching Resources | Teachers Pay Teachers calculating sales tax has never been so much fun with these realistic and engaging flyers and worksheets! 2 differentiated levels included!kids use the flyers to find prices, add to find total amount spent, calculate and add on the sales tax and decide how much money they'll need to pay for their stuff, and viola!, they just went …

IXL | Learn 6th grade math IXL offers hundreds of sixth grade math skills to explore and learn! Not sure where to start? Go to your personalized ... Percents - calculate tax, tip, mark-up, and more 8. Simple interest W. Time. 1. Elapsed time 2. Time units 3. Find start and end times X. Coordinate plane. 1. Describe the coordinate plane 2. Objects on a coordinate plane 3. Graph points on a coordinate plane 4. …

Calculate Sales Tax | Worksheet | Education.com Entire Library Worksheets Fourth Grade Math Calculate Sales Tax. Worksheet Calculate Sales Tax. It would be great if we never had to learn about sales tax, but since we do, 4th grade is as good a time as any! Throw in some favorite baseball game snacks for fun and get cracking. Add the sales tax and find how much each person's meal will cost.

Income Tax worksheet - Liveworksheets.com Income Tax Calculating income tax and money received after deductions. ID: 1342388 Language: English School subject: Math Grade/level: Secondary ... More Math interactive worksheets. Matching Number Name to Numbers (1-10) by khosang: Addition DJ by CPSGradeOne: Place Value by Gierszewski: Mixed Times Table

:max_bytes(150000):strip_icc()/Christmas-Shopping-Worksheet-1-56a602eb3df78cf7728ae5a1.jpg)

0 Response to "38 calculating tax math worksheets"

Post a Comment